Weekly Corn Market Update 12/31/20

December 2021 (Dec21) corn futures (the benchmark for 2021 corn production) finished the week higher by 10.25-cents (~2.41%), settling at $4.3475/bushel. This week's price action took place in a 12.75-cent (~3.00%) range. This week's settlement was in the notable upside band we published last week. Additionally, the week's high of $4.3600/bushel is a new contract high.

Our corn demand index was up 0.34% this week, underperforming Dec21 corn futures for the second straight week. Fundamental discussions should still note increasing concerns over COVID-19, uncertainty surrounding future executive branch policy, and the Georgia Senate races. These three factors continue to provide potential sources of volatility. They are of particular concern where they might impact U.S. and Chinese trade relations. Concerns over South American production are also affecting prices.

Technically speaking, Dec21 corn futures remain in an uptrend that started from the August 2020 lows. Both daily and weekly momentum indicators are in extremely overbought territory. Additionally, Dec21 corn futures extended their upside breach of the channel that has contained the rally since August. We still would not be surprised by a sharp pullback to the $4.10-$4.12/bushel range.

The short-dated options market for the 2021 crop year remains relatively illiquid. However, adequate liquidity in the Dec21 options expiration continues. We still hold a few short-dated March puts to protect our Quartzite Precision Marketing clients until the spring price begins setting in February. Implied volatility for options on the 2021 corn crop strengthened again this week, with the short-dated May expiration leading the way. Implied volatilities are, in our opinion, at elevated levels. As such, we would look to use the minimum number necessary to manage production uncertainty. However, we do not believe that implied volatility has risen to the point where a speculative short volatility bet is justified. We believe the short-dated June expiration now offers the best value for hedgers. However, liquidity concerns could prevent establishing positions at favorable levels. See the chart below for a comparison of our closing at-the-money model volatilities for this week and last.

Looking ahead to next week for Dec21 corn futures, we would consider movement within the $4.2475-$4.4675 per bushel range to be unremarkable. Notable moves would extend to the $4.1375-$4.6200 per bushel range. Price action beyond that would be extreme. We will return to publishing a chart of these levels versus price action next week. Be sure to visit our Twitter page to vote in the poll we hold there each week. While you are there, please give us a follow.

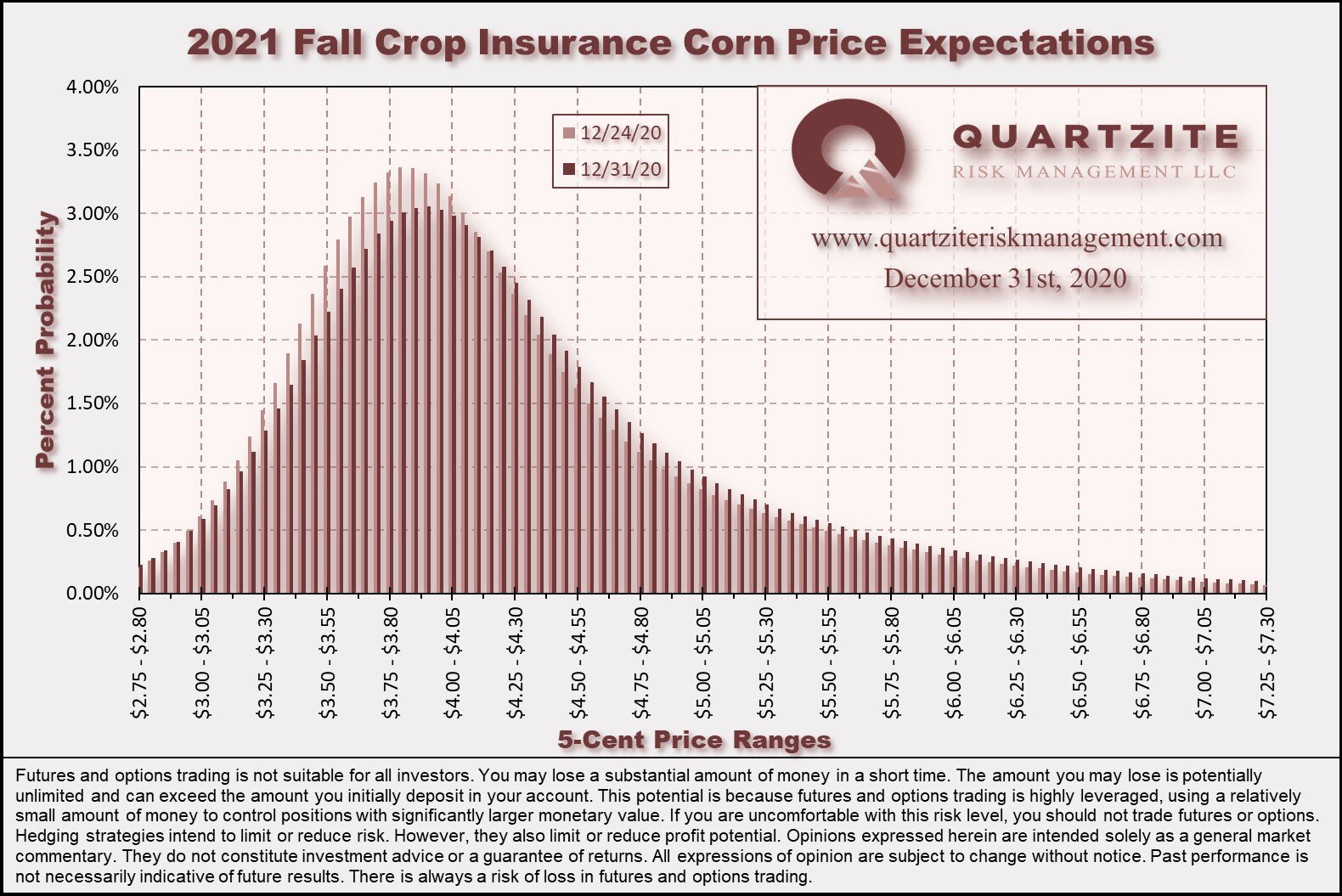

Looking at the Spring and Fall prices for crop insurance this week, both distributions shifted slightly higher due to the rally. A quick note on the Spring Crop Insurance Price charts from the past few weeks. We were pulling the chart data from the wrong part of the spreadsheet - our apologies. This week's spring charts will look slightly different, and we will be updating all prior articles from 11/20/20 to 12/24/20 to reflect the charts as they should have appeared. See below for distribution and cumulative probability charts for both the Spring and Fall crop insurance prices.

We did not add any new Tools and Tactics articles this week but promise to be back with a new one next week. Feel free to take this opportunity to dive into our articles on the Greeks.

Lastly, we would like to take a few seconds to remind you that now is the time to be thinking about your 2021 marketing plan. We usually begin hedging for our Quartzite Precision Marketing clients in February while the spring crop insurance price is setting. The account opening process can take a few weeks, which does not leave much time. We think it is better to be a week early than a week late. So, if you want to learn more, give us a call.

Thanks for taking the time to read. We look forward to your questions and feedback. Please feel free to contact us via our contact form, Facebook, Twitter, email, or phone at (970)294-1379. Thanks again. Have a great week.