Weekly Corn Market Update 05/27/22

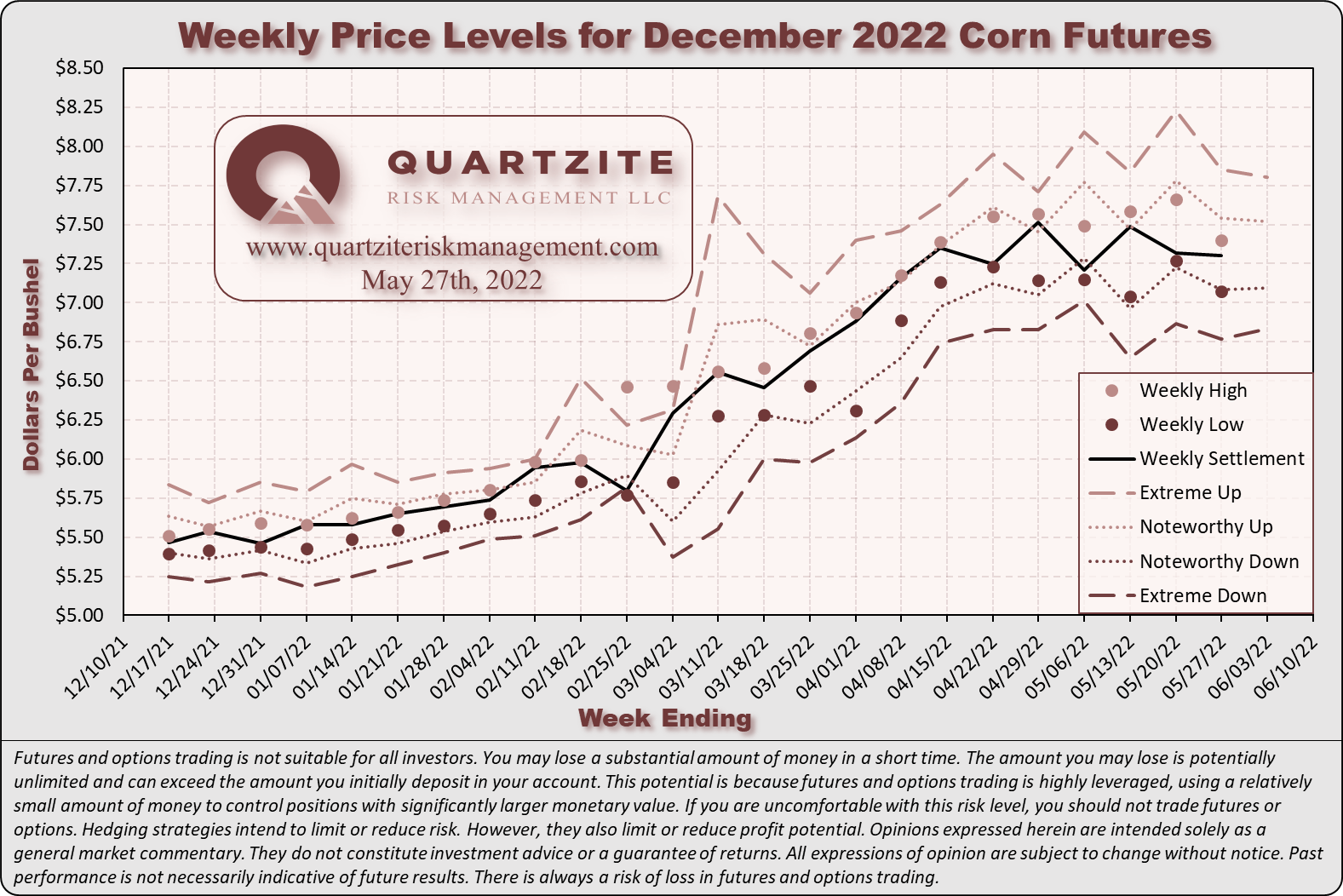

December 2022 (Dec22) corn futures (the benchmark for 2022 corn production) finished the week lower by 2.00-cents (~0.27%), settling at $7.3000/bushel. This week's price action took place in a 33.00-cent (~4.51%) range. This week's low was 1.50-cents below the unremarkable range we published last week.

Our corn demand index (CDI) outperformed Dec22 corn futures, rising 2.82%. The CDI remains significantly below Dec22 corn futures. We believe production concerns need to come to fruition to sustain the premium Dec22 corn futures have to the CDI. Russia's war with Ukraine continued dominating headlines this week, and we expect these headlines to continue driving volatility. Executive branch policy, tensions with China, Federal Reserve interest rate policy, and the Dollar remain significant concerns.

Dec22 corn futures remain in a long-term uptrend supported by a trendline connecting the lows of 03/31/21 and 09/10/21. Dec22 corn futures remain above the upper end of a channel formed using the 05/07/21 high as an upper boundary parallel to that trendline. Dec22 corn futures settled the week below a steeper, shorter-term trendline connecting the lows of 02/25/22 and 03/29/22 - a potentially bearish signal. We would not be surprised by a pullback testing support below the market near $7.14, $7.04, $6.88, $6.58, or even $6.30/bushel. Significant long-term support is between $5.26 and $5.35 per bushel and would require a substantial break in the longer-term trend to test. Above the market, we see resistance around $7.57 and $7.66/bushel. Most daily momentum indicators remained neutral this week, while weekly momentum indicators are neutral to overbought. Daily Bollinger Bands bandwidth finished little changed this week. Carry spreads from Dec22 to Mar23, May23, and Jul23 finished mixed this week, but essentially unchanged.

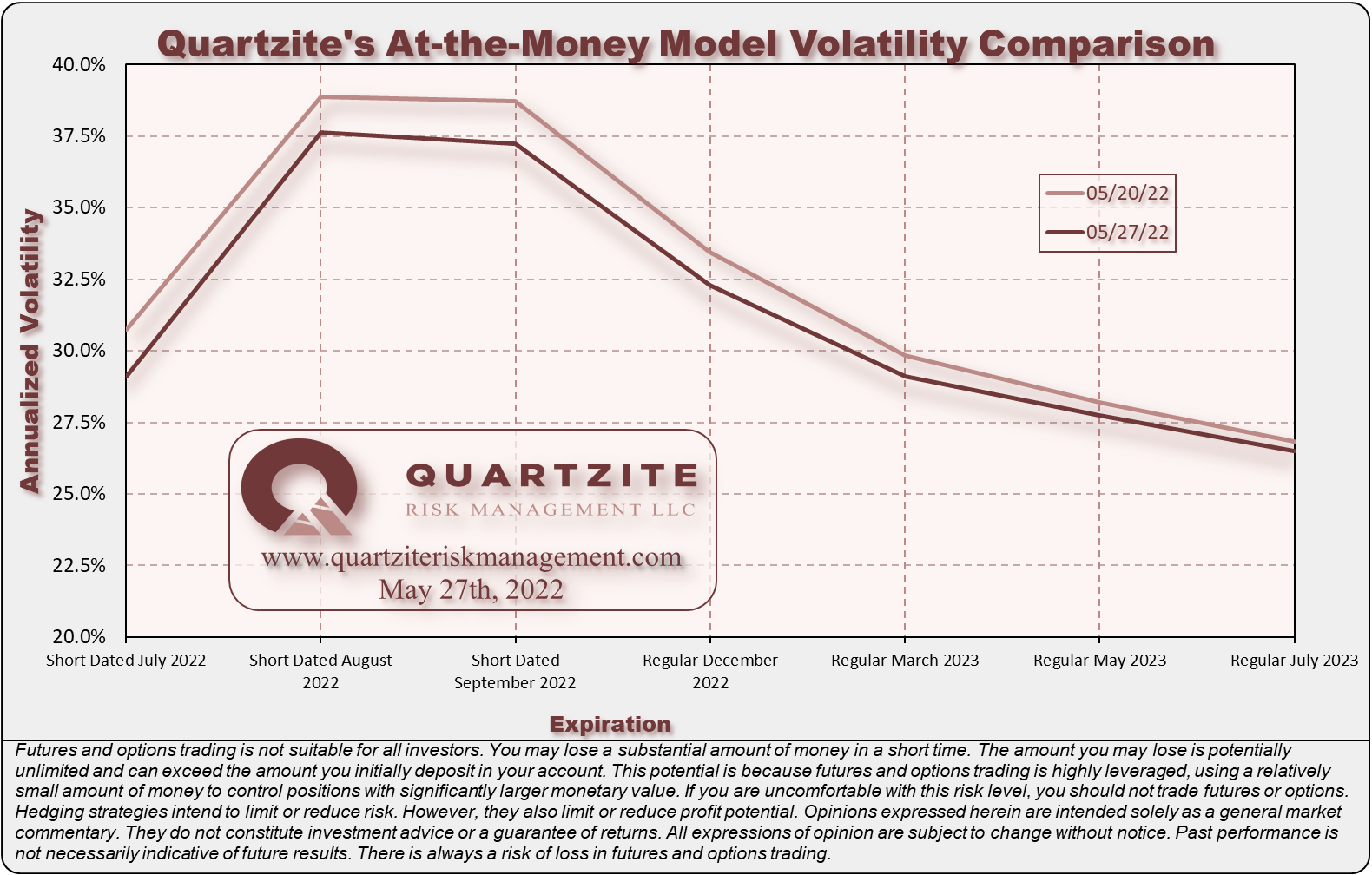

Our at-the-money model volatilities for the 2022 crop finished lower this week. Given the still high implied volatilities in the options market, we believe opportunistic spreading and careful position management are crucial to managing production uncertainty and volatility risk. Given the term structure of volatility, we still prefer the short-dated July and regular December expirations. See the charts below for more details. One compares our closing at-the-money model volatilities for this week and last. The other compares our current model volatilities with the forward volatilities they imply between consecutive expirations.

For next week's trading in Dec22 corn futures, we consider trade in the $7.0925-$7.5175 per bushel range unremarkable. Notable moves extend to the $6.8325-$7.8025 per bushel range. Price action beyond that would be extreme. Be sure to visit our Twitter page to vote in the poll we hold there each week. While you are there, please give us a follow.

Our median Fall Price estimate is $6.9050 per bushel this week, with a mode between $6.55 and $6.60. This week, the Fall Price distribution narrowed with decreased implied volatility.

We were pretty inactive in the new crop corn market for our Quartzite Precision Marketing customers. We purchased some slightly-out-of-the-money short-dated July puts based on softening implied volatility on Wednesday. Additionally, we recommended some cash sales and executed futures sales for several customers to help square their positions as they completed planting. We still believe that producers should protect their investment in expensive inputs with a disciplined and flexible risk management strategy like the one at the heart of Quartzite Precision Marketing. It may be a good time to consider your 2022 marketing plan. If you have any questions or want to learn more about what we do, please reach out. We are always happy to chat about the markets, and there is no obligation.

#AgTwitter & #oatt - cast your vote in this week's poll, then click over to read our Weekly #Corn #Market Update:https://t.co/gEWB5SAnRi…

— Quartzite Risk Management LLC (@QuartziteRMLLC) May 27, 2022

We think these scenarios are equally likely for next week. Where will Dec22 corn #futures settle?

Thanks for taking the time to read. We look forward to your questions and feedback. Thanks again. Have a great week.

(970)223-5297 - Email - Contact Form - Twitter - Facebook

Weekly Price Levels and Corn Demand Index

As a reminder, the Quartzite Risk Management Corn Demand Index references the weekly change in April 2023 futures for Crude Oil, Live Cattle and Lean Hogs. We weigh the percentage change in those contracts and compute the index's percentage change. Crude Oil accounts for 50% of the index, and Live Cattle and Lean Hogs each make up 25%. To create the chart, we started the index at the Dec22 corn futures settlement on 11/12/21; then added or subtracted the index's weekly percentage change. We want to add a few warnings. First, there are only a handful of data points - not much to go on. Second, the index references relatively illiquid markets - making any strategy based on it challenging to execute. Third, we expect divergences to increase as we get into the growing season when the corn market will likely look more toward supply for its direction. In short, we would not attempt to trade on this information without much more data, nor would we recommend anyone else does.