Weekly Corn Market Update 02/11/22

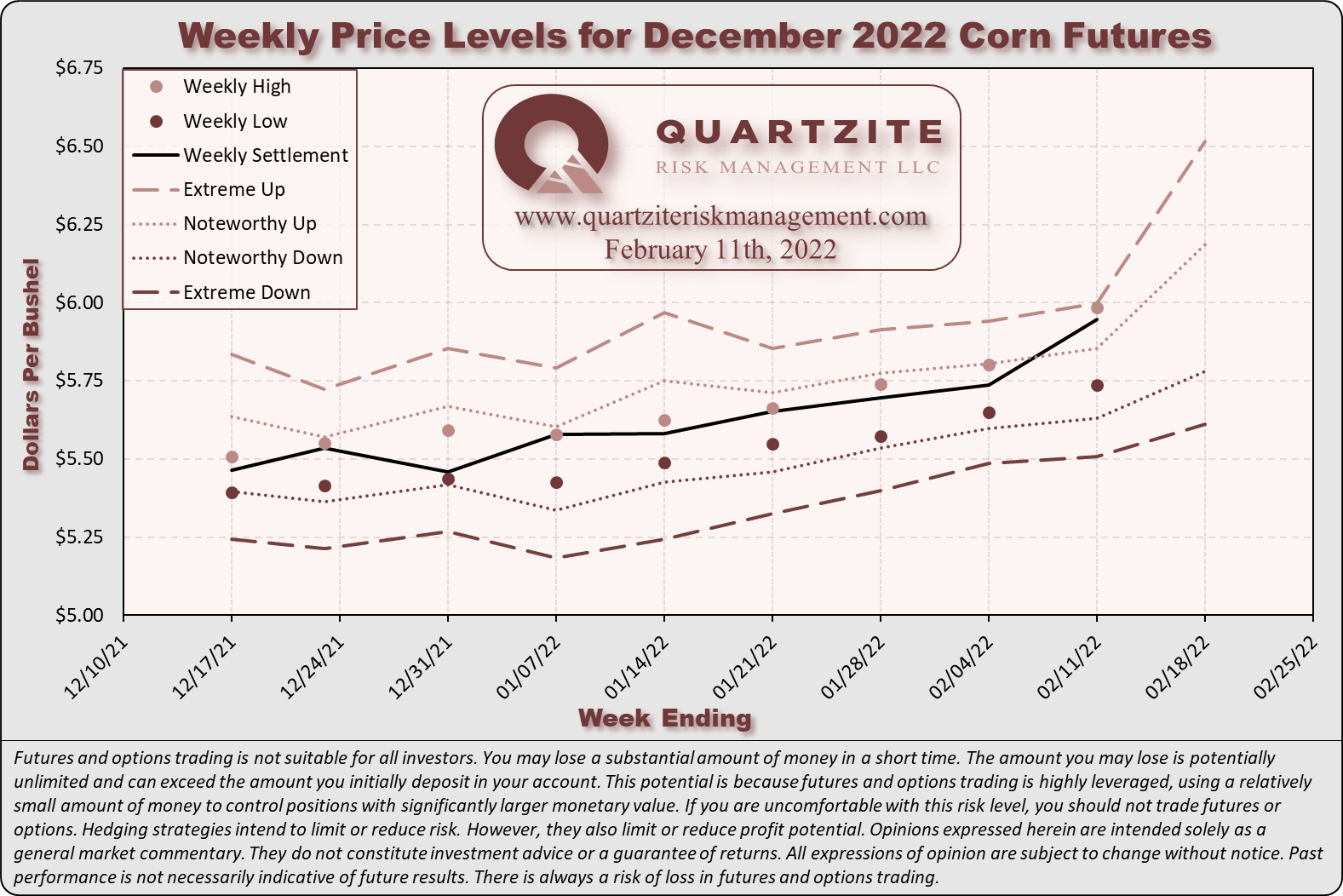

December 2022 (Dec22) corn futures (the benchmark for 2022 corn production) finished the week higher by 21.00-cents (~3.66%), settling at $5.9475/bushel. Dec22 corn futures established another new contract high of $5.9850/bushel on Thursday. This week's price action took place in a 24.75-cent (~4.31%) range. The weekly high was 1.25-cents below the extreme upper band we published last week.

Our corn demand index (CDI) rose 1.31% this week, underperforming Dec22 corn futures. On Friday afternoon, tensions between Russia and Ukraine took center stage in our fundamental concerns. Shortly before the grain markets closed, PBS reported, "The United States believes Russian President Vladimir Putin has decided to invade Ukraine and has communicated those plans to the Russian military..." Shortly after that, corn prices and implied volatilities moved significantly to the upside - indicating heightened uncertainty. Additionally, COVID-19, executive branch policy, tensions with China, Federal Reserve interest rate policy, and the Dollar remain significant concerns. We believe these factors will continue to provide potential sources of volatility for the foreseeable future. Increased input costs for corn production continue to impact acreage decisions this year. However, recent strength in Dec22 corn futures may offset the impact of higher input prices.

Dec22 corn futures remain in a long-term uptrend supported by a trendline connecting the lows of 03/31/21 and 09/10/21. Near-term support sits below the market at $5.65/bushel. Additionally, significant support rests below the market between $5.26 and $5.35 per bushel. Most daily and weekly momentum indicators now show overbought readings. Several momentum indicators on the weekly chart still show divergence with price action since the old contract-high on 11/24/21. Bollinger Bands expanded aggressively this week - beware of false breakouts. Carry spreads from Dec22 to Mar23, May23, and Jul23 finished mixed on the week.

Implied volatilities for the 2022 crop jumped this week, with a good deal of the gains coming late in Friday's session. Implied volatilities for the 2022 crop remain high relative to recent years before the 2021 crop year. Given the high implied volatilities in the options market, we believe opportunistic spreading and careful position management are essential to managing production uncertainty and volatility risk. See the charts below for more details. One compares our closing at-the-money model volatilities for this week and last. The other compares our current model volatilities with the forward volatilities they imply between consecutive expirations.

Looking ahead to next week's trading in Dec22 corn futures, we would consider movement within the $5.7800-$6.1850 per bushel range to be unremarkable. Notable moves would extend to the $5.6125-$6.5150 per bushel range. Price action beyond that would be extreme. Be sure to visit our Twitter page to vote in the poll we hold there each week. While you are there, please give us a follow.

This week our median Fall Price estimate is $5.5825 per bushel, with a mode between $5.20 and $5.25 per bushel. The Spring Price continued its discovery period, and with 47.37% of the observations in, the average so far is $5.8042/bushel. The Fall Price distribution shifted higher with the rally this week and widened considerably with increases in implied volatility.

#AgTwitter & #oatt - cast your vote in this week's poll, then click over to read our Weekly #Corn #Market Update:https://t.co/Dt1tiZDMlq…

— Quartzite Risk Management LLC (@QuartziteRMLLC) February 12, 2022

We think these scenarios are equally likely for next week. Where will Dec22 corn #futures settle?

We have done some hedging for our Quartzite Precision Marketing customers for the 2022 season. We continue to recommend cash contracting portions of 2022 production as producers book inputs. This week, we made a few trades for our Quartzite Precision Marketing customers. On Thursday, we purchased a small number of near-the-money Dec22 put options. After the PBS story we mentioned above broke Friday afternoon, we bought some short-dated March call options. We later sold half of this position out at levels that covered the entire initial purchase - leaving the second half as a short-term hedge against developments in Ukraine into next week. Despite the uptrend in Dec22 corn futures and geopolitical risk, we continue to believe that producers should protect their investment in expensive inputs with a disciplined and flexible risk management strategy. There is still time to consider your 2022 marketing plan. If you have any questions or want to learn more about what we do, please reach out. We are always happy to chat about the markets, and there is no obligation.

Thanks for taking the time to read. We look forward to your questions and feedback. Thanks again. Have a great week.

(970)294-1379 - Email - Contact Form - Twitter - Facebook

Weekly Price Levels and Corn Demand Index

As a reminder, the Quartzite Risk Management Corn Demand Index references the weekly change in April 2023 futures for Crude Oil, Live Cattle and Lean Hogs. We weigh the percentage change in those contracts and compute the index's percentage change. Crude Oil accounts for 50% of the index, and Live Cattle and Lean Hogs each make up 25%. To create the chart, we started the index at the Dec22 corn futures settlement on 11/12/21; then added or subtracted the index's weekly percentage change. We want to add a few warnings. First, there are only a handful of data points - not much to go on. Second, the index references relatively illiquid markets - making any strategy based on it challenging to execute. Third, we expect divergences to increase as we get into the growing season when the corn market will likely look more toward supply for its direction. In short, we would not attempt to trade on this information without much more data, nor would we recommend anyone else does.